What a year it’s been and the resiliency of asset markets in the face of everything that was thrown at it was truly amazing!

We are living through unprecedented times with technology and crypto experiencing another bull market, U.S. elections in 2024, and potential rate cuts around the world. Could we be “back to the races” again this year?

One exercise that we all do at the beginning of the year is to adjust our personal investment portfolio to reflect what we expect to unfold in the world over the short, medium, and long term.

For many, including myself, that means increasing the allocation to crypto and U.S. real estate investments.

The simple key to making long-term money is to create a portfolio of non-correlated investments, and there is no better time to increase your U.S. real estate investment exposure.

Our goal in 2024 is to bring more education, experience, and strategies to our client's real estate investing.

We are living through unprecedented times, and we want to be there for you on your journey as an international real estate investor.

Message me if you want to know what I recommend as your real estate exposure vs. your overall portfolio.

U.S. Real Estate Market - What Just Happened?!

In a year that saw:

- 10-year Treasury yields at 5%

- 30-year mortgage rates at 7-8%

- Inflation as high as 6.5%

How did:

- Home prices rise across the country; in some metro areas 10-15%

- S&P +25%; Nasdaq +55%

How did everyone get it wrong?

In hindsight, it is clear to me that the extent of the positive impact of various layers of government stimulus going back to COVID (including the Fed’s BTFP) was severely misunderstood and underappreciated.

Now, with inflation and employment (Fed’s dual mandate) seemingly under control, most of the world now expects around a 75 bps cut in Fed Funds rates (echoed by the Fed’s new dot plot).

Hat’s off to our GMG Research team, which mid-2022 called for a supportive U.S. property market in 2023, but never did we expect a rising market to this extent.

Our thesis was simple - it was based on the fact that:

- 24% of homeowners have their mortgages < 3%

- 63% are locked-in < 4% and

- 83% of homeowners have mortgages < 5%

- Severe lack of supply

Existing Homes

In any marketplace, you need supply and demand. For U.S. real estate, the supply is Existing Homes and New Homes. Existing Home Sales are about 90% of Total Home Sales in the U.S.

Given that 83% of existing homeowners have a mortgage < 5%, they would have to be under financial stress to sell, given their new mortgage would cost 7-8%. As you can imagine, Existing Home Sales is at a 13-year low!

New Homes

It’s widely known that there is a major shortage of homes in the U.S.; between 3-6M units, depending on what you read.

Lack of Homebuilder Motivation

With higher borrowing costs, higher commodity prices, and higher wages - there is no financial motivation for homebuilders to increase their development, given the lower margin potential from higher costs.

More importantly, demand and affordability will be dampened by higher-for-longer mortgage rates.

Remember, the large homebuilders are all publicly traded companies with CEOs compensated on share price performance.

Higher profit => Higher EPS => Lower PE => Institutional Buying => Higher share prices => Higher CEO bonuses!

Sun Belt is Rising!

Elsewhere, the national reshoring of manufacturing is happening; it's happening now, and it's happening fast!

States like Georgia, Texas, and Florida are experiencing an unprecedented influx of employment seekers to match the growing opportunities.

Between January 2020 and January 2023, rents for a two-bed detached home increased about 44% in Tampa, Florida, 43% in Phoenix, and 35% near Atlanta.

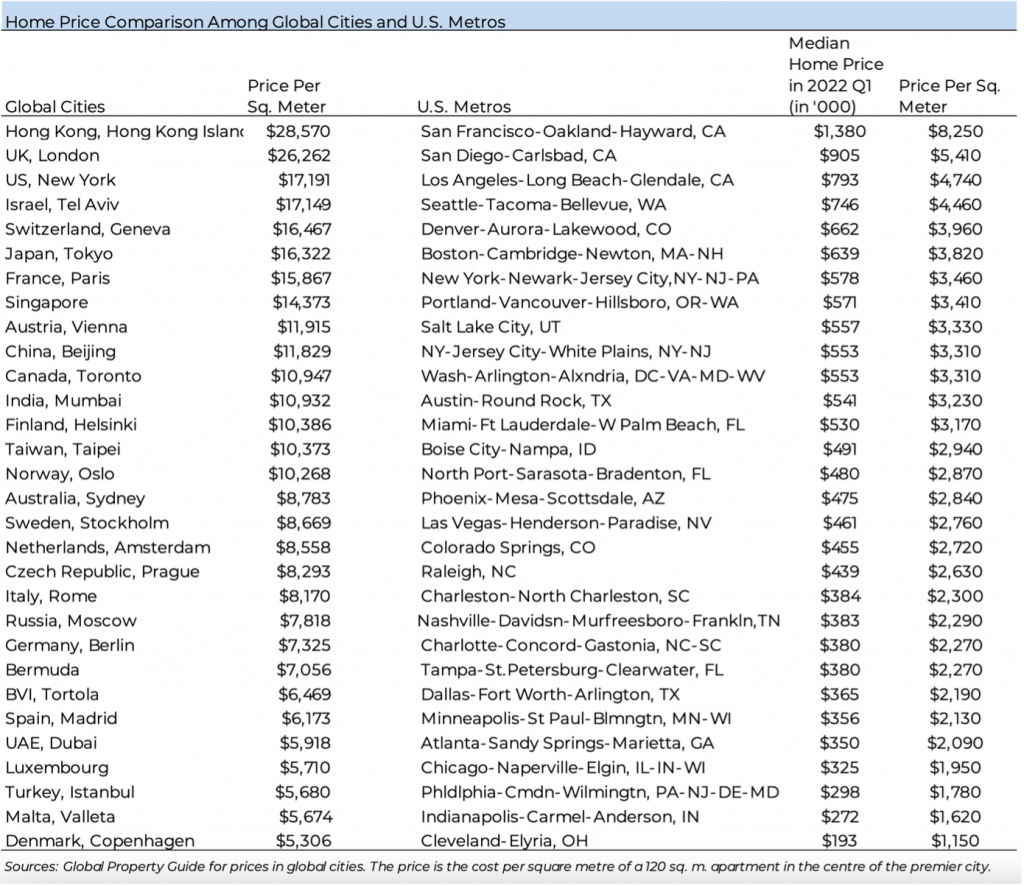

Why is this important for you (international property investor)?

Many Americans will not be able to afford a mortgage even if rates fall to 5-6%, so they will have to rent.

In the states mentioned above, we are seeing gross rental yields of 12% already!

I have no doubt that rental yields in these states will be 15% sooner than we think.

You know who else knows this?

Wall Street, aka Private Equity (aka Blackstone and its pals)

Single-family homes are the next big institutional investment opportunity given its sheer scale and for the reasons I mentioned above.

There have been many articles published this year about how institutions may own up to 40-60% of single-family home supply by 2030!

Hear Bobby Kennedy Jr’s speech on this

As an investment banker for over 20 years with Blackstone as its client, I can assure you if there is money to be made, they are going to make it!

The Perfect Storm to Invest in U.S. Real Estate

- Extremely supportive supply demand

- Low-entry price point

- Ease of transaction

- High leverage (even for foreign nationals living overseas)

- Tailwind of institutional buying and

- Plenty of ways to maximize cash flow (lower tax)

Home prices will certainly go higher, given the expectation of lower rates in 2024!

If you are interested in taking your first step in owning a U.S. real estate investment property, send me a private message, and I can walk you through the entire process:

- How to find the right city to invest in

- Which cities have the highest rental yield

- Setting up an LLC and bank account

- U.S. tax specialist specializing in international investors

- Property manager

- Realtor….and, of course,

- Financing for foreign nationals or expats living overseas

2023 In Review

Bank stuff…

Silicon Valley Bank was put into receivership after it failed to raise needed capital. SVB’s closure was the largest bank failure in U.S. history since the 2008 financial crisis. This led to the collapse of cryptocurrency-focused Silvergate Bank and Signature Bank as well.

The implosion of these three small-to-mid-sized U.S. banks ignited contagion fears across the globe in the months that followed, prompting the Federal Reserve to set up a US$12B emergency lending program - known as the Bank Term Funding Program (BTFP). More on this later.

The programme couldn’t save First Republic Bank from closing down and was ultimately sold to JPMorgan Chase.

This was just an amuse-bouche for what happened next as Credit Suisse collapsed with UBS paying only CHF 3B to save the company, a deal brokered by the Swiss government. Google “AT1 bonds,” and the story gets even crazier.

Crypto stuff…

- January - BTC $16,000; ETH $1606; SOL $9.9

- February - Kraken shuts down

- March - SVB collapses; Arbitum launches ARB token

- April - ARK refiles Bitcoin ETF

- May - DOJ investigation on Binance for Russia sanctions

- June - SEC sues Binance CEO; Blackrock files for spot Bitcoin ETF; Fidelity, Wisdom Tree, VanEck refiles Bitcoin ETV

- July - Blackrock CEO says BTC “could revolutionize finance”; Ripple won ruling

- August - Paypal launches stablecoin, Grayscale wins lawsuit with SEC,

- September - Nomura launches Bitcoin fund

- October - 1st ETH futures ETF launched

- November - SBF found guilty; Blackrock files for spot Ethereum ETF; Binance settles lawsuit and CEO steps down

- December - BTC $40,000; ETH $2,396; SOL $105

Bad actors were removed, Binance settled, Ripple won, Bitcoin spot ETF (only a matter of time), and MicroStrategy bought $600M of BTC at $42K last night!

AI stuff…

It’s mind-boggling that ChatGPT reached 100 million users in just 2 months after launch. Just guessing here, but it must be the fastest adoption of any form of technology, language, or service in the history of humankind. The scary thing is that it’s only getting started. It’s now a necessary tool for nearly all organizations (ChatGPT is writing this now…just kidding).

An event prescient of things to come was the Hollywood strike, which, at the core, was about protecting Hollywood jobs from AI. The delay of Dune 2 till March 2024 was the biggest disappointment to me personally.

Nvidia, the only company that is able to make chips capable of crunching AI’s large language models, saw its stock +200%. The rest of the tech incumbents went along for the ride: Meta +250%, Tesla +100%, Google, and Microsoft, both +50%+.

Fun stuff….

- Taylor Swift’s x ERAs tour is generating more GDP than many small countries. I’m a massive Swiftie, so bummed I couldn't get tickets.

- Taylor Swift x Travis Kelce

- Barbie x Oppenheimer

- Coronation of King Charles III and Camilla

Sad stuff…

- Hamas and Israel

- Hawaii forest fires

- Titan x Titanic

- Matthew Perry, Tina Turner, Sinead O’Conner

Crazy stuff…

- Twitter rebrands to X

- George Santos gets expelled from the House of Representatives

- Kevin McCarthy gets ousted as Speaker of the House

- Torrential rain flooded Burning Man (I was supposed to go)

- The Cricket World Cup breaches 1 trillion viewing minutes globally

- Watching Harvard and UPenn botch their response to the ME events

- Ozempic, a diabetes drug popular with Hollywood actors to lose weight, became mainstream to the point its manufacturer, Novo Nordisc, was the largest market cap stock in Europe, larger than LVMH!

- Even crazier, General Mills had to research the impact Ozempic had on their business, given the potential lack of calorie consumption.

Sports stuff…

- Messi-mania goes nuclear in Miami

- Inter Miami is the most searched sports team on Google

- Lebron surpassing Kareem in most points scored

- South Africa wins the Rugby World Cup

- Australia wins the Cricket World Cup

Update of our Global Financing Capabilities

- International Residential Mortgages

U.S., Canada, Mexico, U.K., France, Spain, Portugal, Italy, Dubai, Singapore, Japan, Thailand, Australia - International Asset-backed (Bridging) Loans

U.S., Canada, U.K., Singapore, Thailand, Philippines, Australia - Asian Real Estate Structured Debt Financing

Most of Asia - Listed Share Financing

Most of Asia and the U.K.

I want to thank all our stakeholders for joining us on our journey to disrupt how international investors secure financing for global real estate investments.

We wish you abundant health, wealth, and happiness in 2024!

Happy Hunting!

[email protected]