In the world of real estate investing, opportunities often arise that demand swift action and access to immediate liquidity. Whether it's seizing a lucrative investment, capitalising on a time-sensitive deal, or making cash available to expand your business, savvy investors need a financial solution that bridges the gap or "bridge" between the present and the future.

Enter real estate bridge loans – a powerful tool that provides experienced and sophisticated international real estate investors with the flexibility and speed they need to navigate the dynamic landscape of property transactions.

In this article, we delve into why real estate bridge loans are not only for the Ultra High Net Worth and now has emerged as an excellent option for anyone seeking liquidity – a true game-changer in the market.

1. Global Offering:

- GMG offers Bridge Financing in these countries, by far the most comprehensive coverage for any financing company globally.

- USA, Canada, U.K., Singapore, Hong Kong, India, Thailand, Philippines, and Dubai, to name a few.

2. Speed and Surety:

- One of the most significant advantages of real estate bridge loans is their ability to expedite transactions. Traditional financing methods, such as mortgages or bank loans, often involve lengthy, often complicated approval processes and extensive paperwork, which can hinder the momentum of time-sensitive deals.

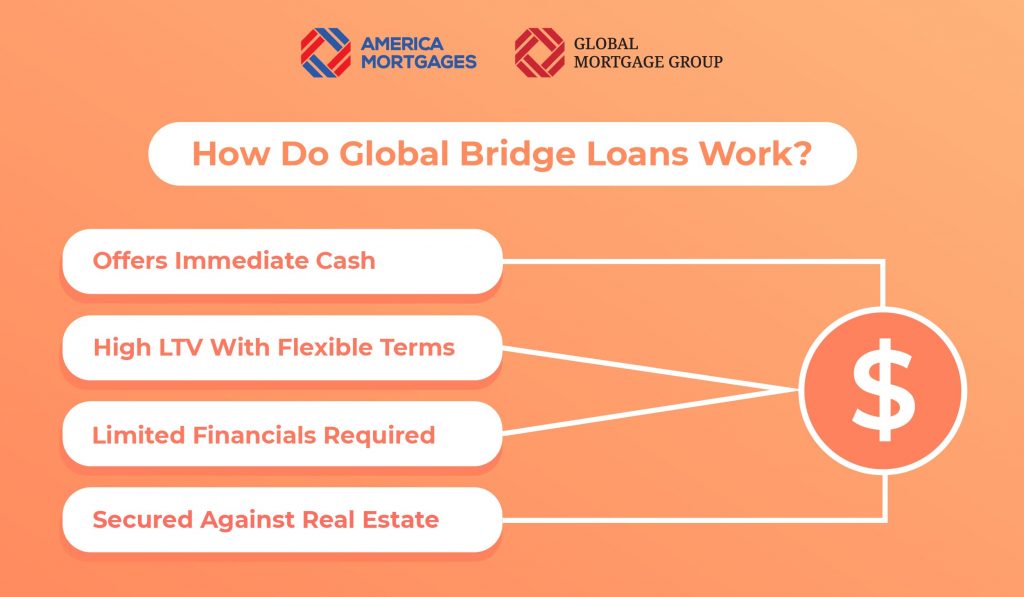

- Bridge loans, on the other hand, are designed for speed, enabling borrowers to access funds quickly and capitalise on time-critical opportunities. Global Mortgage Group's streamlined application process and reduced documentation requirements make bridge loans an attractive option for those seeking liquidity within a short timeframe.

3. Flexibility to Maximise Returns:

- Real estate investments come in various shapes and sizes, and each opportunity demands a unique approach. Bridge loans provide investors with the flexibility they need to customise their financial strategies.

- Whether it's acquiring distressed properties, renovating assets, or transitioning between different projects, bridge loans offer borrowers the freedom to act on their investment ideas without being constrained by rigid terms and conditions.

- This flexibility empowers international real estate investors to make swift decisions, seize opportunities, and maximise their returns.

4. Mitigating Risks and Overcoming Hurdles:

- Real estate transactions often encounter obstacles and uncertainties that can hinder the flow of traditional financing.

- Bridge loans have proven to be a reliable solution for overcoming these hurdles and mitigating risks.

- For instance, investors may face challenges when purchasing properties that do not meet the stringent criteria of conventional lenders, such as distressed assets or properties requiring significant renovations.

- Bridge loans overcome this gap by providing financing options based on the property's potential value rather than its current condition.

- By evaluating the underlying asset's potential, bridge loans offer borrowers the ability to navigate challenging circumstances and unlock hidden value.

5. Competitive Advantage:

- In a highly competitive real estate market, having a competitive edge can make all the difference.

- Real estate bridge loans provide international real estate investors with a unique advantage by allowing them to act swiftly and confidently. This advantage allows borrowers to negotiate more effectively, secure desirable properties, and position themselves as reliable buyers in the eyes of sellers.

- By leveraging the liquidity and flexibility bridge loans offer, investors can differentiate themselves and stay ahead of the competition.

6. Seamless Transition and Timing:

- In the real estate market, timing is everything.

- Bridge loans enable investors to align their financial strategies seamlessly, eliminating the need to wait for the sale of existing properties or long-term financing to materialise.

- These loans allow borrowers to secure the necessary funds quickly, ensuring a smooth transition from one project to another.

- By bridging the gap between selling one property and purchasing another, investors can maintain their momentum and capture opportunities that may otherwise be missed.

Conclusion

Global Mortgage Group presents real estate bridge loans as an excellent option for those seeking liquidity in the dynamic world of real estate. With the ability to facilitate swift transactions, offer flexibility, provide bespoke structure, mitigate risks, ensure seamless timing, and deliver a competitive advantage, these bridge loans have become an invaluable tool for investors.

While America Mortgages, a subsidiary of GMG, specializes in U.S. bridging loans, GMG's expertise extends worldwide through its offering of global bridging loans. Whether you're in the United States, Australia, Canada, U.K., Singapore, Hong Kong, India, Thailand, Philippines, Dubai, or anywhere else, GMG and its subsidiary, America Mortgages, are the trusted firms relied upon by investors worldwide. To learn more about our comprehensive financing solutions, visit www.GMG.asia or www.AmericaMortgages.com.