Singapore is known for academics and education, with many high school graduates attending the best universities in the world!

Similarly, the U.S. is known for having most of the top global universities.

Singapore currently has 21,666 students studying abroad, according to UNESCO, and according to a recent Open Door report, Singapore had 3,901 students studying in the U.S. – a record number!

A typical Asian family will want to explore owning a property near the university the child will be attending – as a place to stay when visiting or if the student prefers not to stay in the dormitory.

After graduating, the property’s value often goes up. It might be enough to pay for college, or parents might choose to give the property to their child if they plan to work in the U.S. before returning home. This allows the child to build credit, something very important in the U.S.

However, not many can pay for a home with cash and just give up when they assume that obtaining a mortgage is not available.

Contrary to what you may think…..

- You CAN get a mortgage as a non-U.S. citizen or Expat living in Singapore

- You DO NOT need U.S. credit or residency

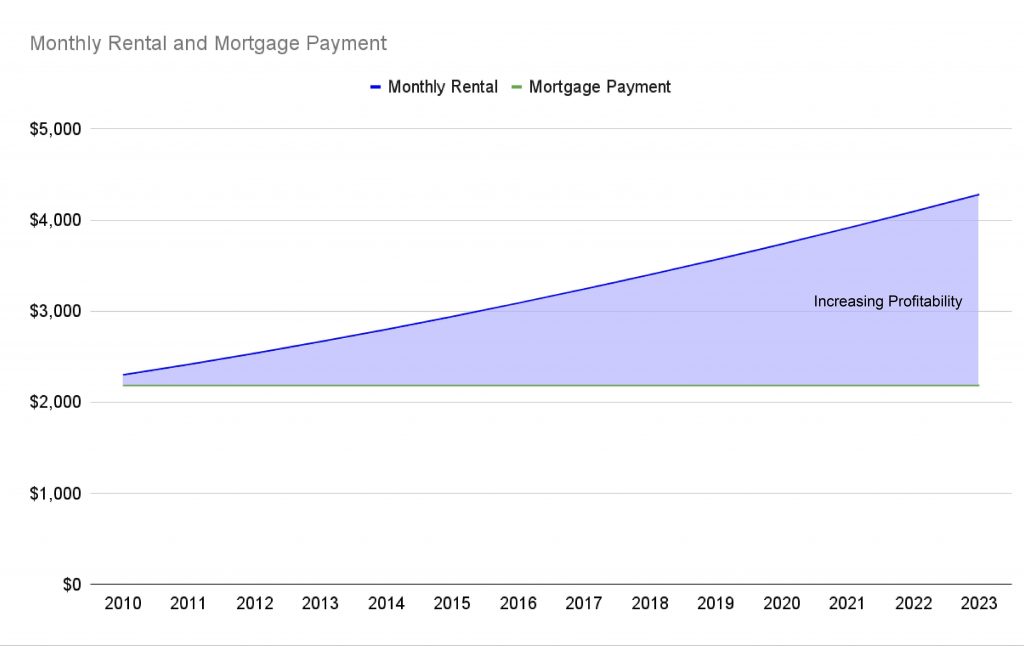

- You CAN QUALIFY based on your Singapore income OR by using the rental income of the U.S. investment property

- You CAN get market-interest rate mortgages while living in Singapore

- You CAN sign the closing documents at the embassy on Napier Road

Actually, we are the world’s first and only U.S.-based mortgage broker with offices in Singapore, right on Telok Ayer. Come visit us for coffee!

Let us guide you through this process from:

- Introducing you to a realtor

- Helping you screen for the best locations to buy

- Setting up your LLC

- Discussing the benefits of using an LLC

- Introducing you to a property manager

[Must Sign Up!] A Singapore Couple’s Path to Financial Freedom through U.S. Real Estate Investing!

Meet Han and Tracy, an incredible couple from Singapore who made a bold move – they left behind their regular 9-5 jobs after successfully diving into the world of U.S. real estate. Now, proud owners of 12 cash-flowing properties, achieved through strategic moves in just three years, they’re here to share their story.

Register for our exclusive webinar “Singapore Couple’s Journey to Financial Freedom through U.S. Real Estate Investing,” on January 18th at 6:30 PM SGT. Join Han and Tracy as they unravel the details of their transformative journey. Learn the secrets of how this dynamic duo achieved financial freedom through their savvy investments in U.S. real estate. Don’t miss out—reserve your spot now!

AM Student+

Investing in your child’s future just got easier. America Mortgages’ Student+ loan program removes the financial barrier for parents who want to purchase a property in the U.S. for their children’s education. This innovative program allows parents to qualify for a loan using the projected rental income of the property, eliminating the need for a U.S. credit history. This means that even parents who are new to the U.S. can provide their children with a safe and comfortable place to live while they study.

With America Mortgages’ Student+ loan program, parents can invest in their children’s future and build wealth at the same time. The program’s flexible terms and competitive rates make it an attractive option for investors. Contact us today to learn more about this unique program and start investing in your child’s bright future.

[email protected]